The COVID-19 crisis was a wakeup call for a lot of RIAs to explore new technology. According to Fidelity, two out of three RIAs

started looking at new financial technology (FinTech) in 2020. But for many RIAs, the fear of converting data from their current

portfolio accounting system (PAS) to a new provider prevents them from making a switch.

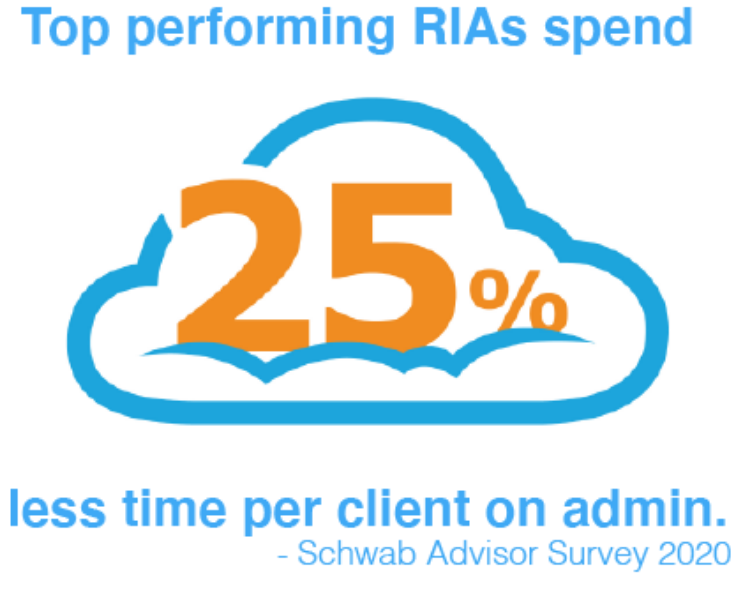

That can be a big risk if a new provider would be a better long-term fit. According to Schwab’s 2020 benchmarking study, top-

performing RIAs spend 25 percent less time per client on administrative tasks. To compete at the highest level, it’s important to

streamline your systems.

That can be a big risk if a new provider would be a better long-term fit. According to Schwab’s 2020 benchmarking study, top-

performing RIAs spend 25 percent less time per client on administrative tasks. To compete at the highest level, it’s important to

streamline your systems.

That can be a big risk if a new provider would be a better long-term fit. According to Schwab’s 2020 benchmarking study, top-

performing RIAs spend 25 percent less time per client on administrative tasks. To compete at the highest level, it’s important to

streamline your systems.

Understanding the conversion process, and the speed at which it can be done, is a great start to getting past any fears you may

have about updating your system. (It’s not as big of a headache as you may think, or as big of a project as some technology

providers make it sound.)

We want you to feel confident taking your firm to the next level, so we’ll use this article to explain how conversions work overall, and how we handle them at Advyzon specifically. It can help to think about the process in three steps: planning, preparation, and execution.

Planning: Start with what you have

Think of shopping for a new portfolio accounting system (PAS) like shopping for a new house. Your first step would be evaluating your existing house to get a sense of your timeline and budget. With PAS providers, it’s important to know what’s going on with your data right now.

There are really only three options when it comes to tracking historical performance: a backup database, custodial source files,

and returns spreadsheets. We’ll go through these in order of most helpful to least.

1. Backup database.

Think of shopping for a new portfolio accounting system (PAS) like shopping for a new house. Your first step would be evaluating your existing house to get a sense of your timeline and budget. With PAS providers, it’s important to know what’s going on with your data right now.

2. Historical source data.

The most likely place to find this data is with your custodian. Many custodians retain pricing and transactional data that you

should have access to, though each custodian varies in terms of how far back they keep records for clients to access. If you’re still importing and reconciling your own data, it’s possible you have all of this source data saved, which can help with a transition.

3. Returns spreadsheets.

Many firms keep returns-only documentation, derived from either their PAS provider database or historical data from their custodians. If you have this data available,note what format you use and how comprehensive your documentation is.

If you’re a breakaway firm, the process is slightly different. Again, think of it like homebuying. While you don’t need to get your current house appraised, you still need to assess your needs and figure out a budget. Here, that means understanding how different potential providers work.

Plan ahead by thinking about what data you can take with you from your current firm. (For a deeper dive, read more about data ownership and what you can take with you.) Then, ask any technology firms you talk to how they store data and what kind of access you have.

Preparation: Choosing a provider

It’s important to understand the transition, or conversion, process. The two most common approaches are transactional and returns-based conversions.

Transactional conversions bring over all of your data down to the individual transactions for each account: buys, sells, dividends, share splits, and so on. Think of this as the “full picture” option since it includes all of the details that comprise performance. However, for firms that don’t have access to as much data (like custodial records), you can also do a returns-based conversion. This carries over each account’s returns, typically on a monthly or quarterly basis. You’ll be able to look back at historical performance, but it will be high level, and not include as many details. Most firms prefer to have as much detail available as possible, so transactional conversions are typically the first choice. Any provider you’re talking to should be able to walk you through what type of conversion you can expect based on the data you currently have available.

Advyzon can walk you through these options when you schedule a consultation.

In addition to the logistics, here also some practical questions to ask:

- Have you had firms similar to mine make this transition, and how long did it take?

- How will I get in contact with my service team when I have a question?

- How will my team train on and learn our new technology?

Knowing this information puts you ahead of the curve when it’s time to execute.

Execution: Communication and speed

Think of execution (when we start the conversion) as the period between when you close on a home and when you move in.

For some of our competitors, conversion can take several quarters. It’s no wonder so many RIAs are reluctant to take that plunge — your business could suffer during any potential downtime. We take that concern seriously. With Advyzon, your conversion timeline will be roughly 12-weeks (a single quarter) and 90 percent of our conversions complete ahead of schedule.

Advyzon’s team averages 14 years of experience: we know how important a quick and seamless transition is, and we built our conversion process with your needs in mind. During those 12 weeks, our team looks at how we can best bring over your data (there’s no one-size-fits-all), then begins converting that data to work with our system. Essentially, we’re building a portfolio accounting system just for you, based on your data.

This process can sometimes take as little as six weeks, and we keep an open line of communication through the entire process. Plus, we have built-in validations along the way to check that things are working.

When conversion is complete, we start training and onboarding your team. Once you give us a thumbs up that your data looks good, and that you understand the system, you make the full switch. There’s no down time.

Don’t let fear hold you back

It’s always scary to update technology, particularly because most new technology comes with a learning curve for you and your team members. But if you choose a provider that can handle conversions quickly, and that offers hands-on support, these are short-term obstacles. Long term, you’ll be better prepared to service your clients and grow your firm into the future.

Don’t let inertia hold you back from making a long-term decision that benefits your clients and your team. Lean into the fear — and speed — of a well-done conversion by planning, preparing and choosing the right partner.

To learn more about how Advyzon might handle a conversion for your firm, including potential timelines, schedule a consultation.