Partnered Trading: Advisor Created, AIM Traded

Run model portfolios your way and let the power of Advyzon’s top-rated

trading platform do the heavy lifting

We get that some advisors prefer to run their own investment strategies. Advyzon’s enterprise-grade trade platform and team execute trades accurately and efficiently, all integrated within the Advyzon ecosystem.

Portfolio Trading—Simplified

- Support Unified Managed Account (UMA) trading to incorporate multiple strategies in one account

- Integrated tool to send customized directions, including cash raise and portfolio changes

- Support trading with all major custodians

- Custom solutions and settings, including maximum annual gains, minimum cash or Dollar percentage, do not buy/sell instructions, etc.

Precise Portfolio Management Control

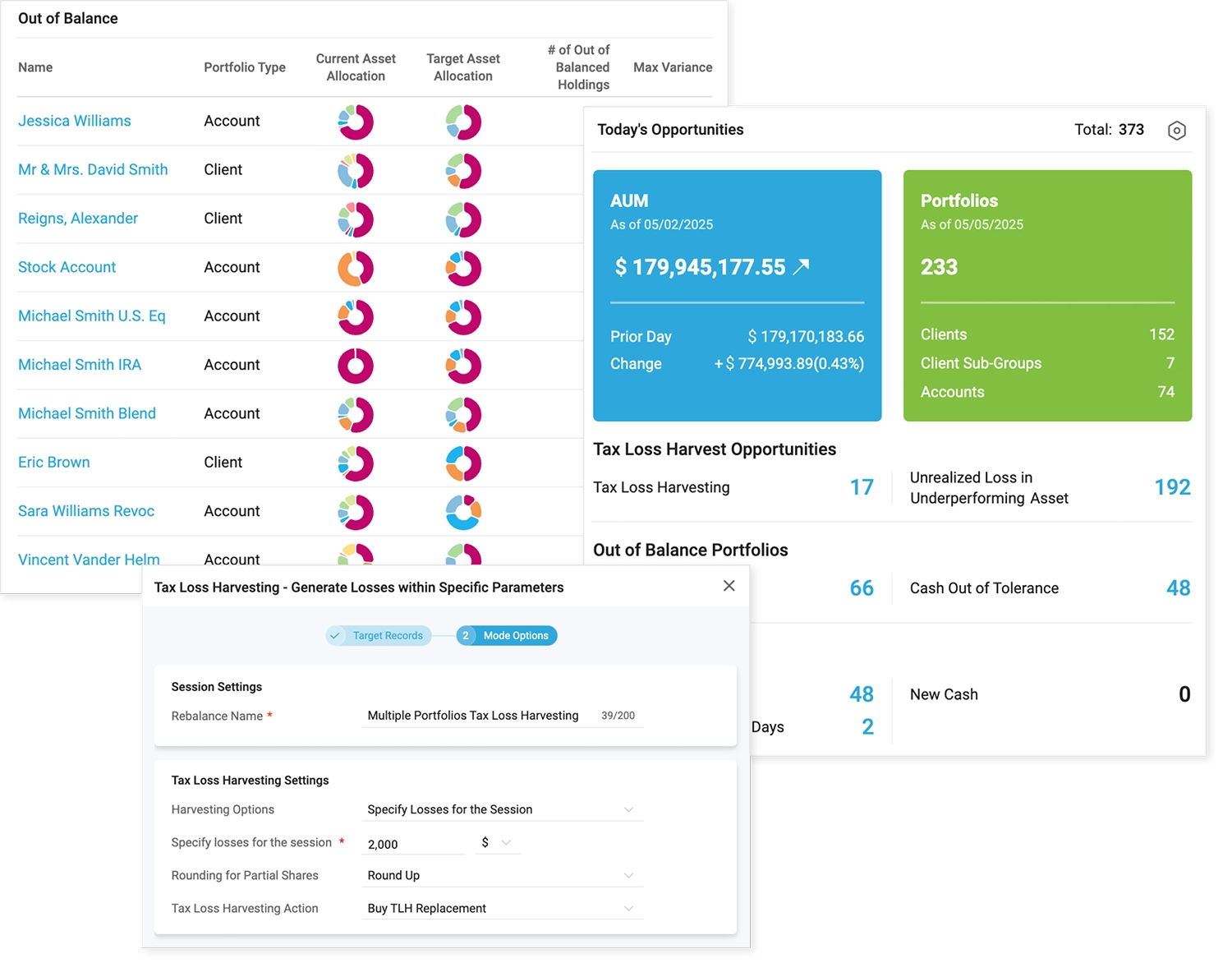

Advyzon has advanced portfolio management tools that allow advisors to build an unlimited number of bespoke portfolios or a simple set of portfolios that can be leveraged across all clients

Our trading tools support a variety of different objectives, including location optimization, cash management, tax loss harvesting, customizable trade preferences, robust model management capabilities, and automated monitoring and processing.

Investment Management that Adapts to Your Needs

AIM offers multiple engagement levels to match the way you run your practice, from full OCIO solutions to support for advisor-directed models with professional trading services.

Our experienced investment professionals can consult with you on best practices around rebalancing, portfolio exclusions, equivalencies, tax strategy, and RMD management.