Rebalancing

A seamlessly integrated experience allows you to leverage existing relationships as tradable portfolios—which means managing and onboarding new clients is simpler than ever.

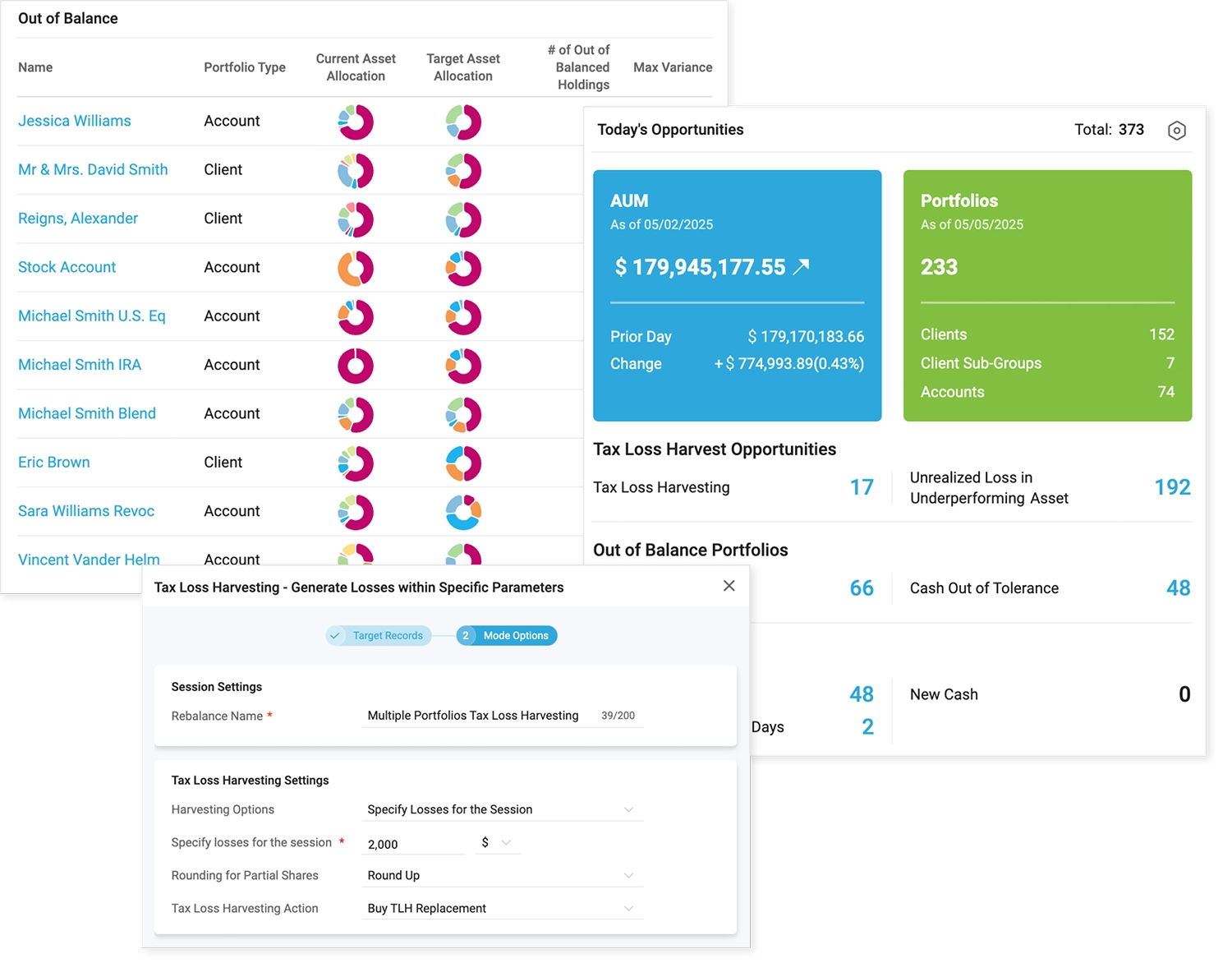

Centralized Command Center

Users can access everything they need in a single dashboard, from data to custodian feeds to risk scores, eliminating the need to navigate multiple systems to perform necessary tasks.

Quantum Highlights

Quantum, our built-in rebalancer, provides powerful, flexible tools that let your investment strategy run at scale.

Model Management

Our robust model options allow for managing strategies at the security or asset class level.

Dashboard

Stay informed on trading opportunities, account changes or cash needs. Our widgets provide insight on accounts, cash activity, portfolios that are out of tolerance, trading statuses, data reconciliation.

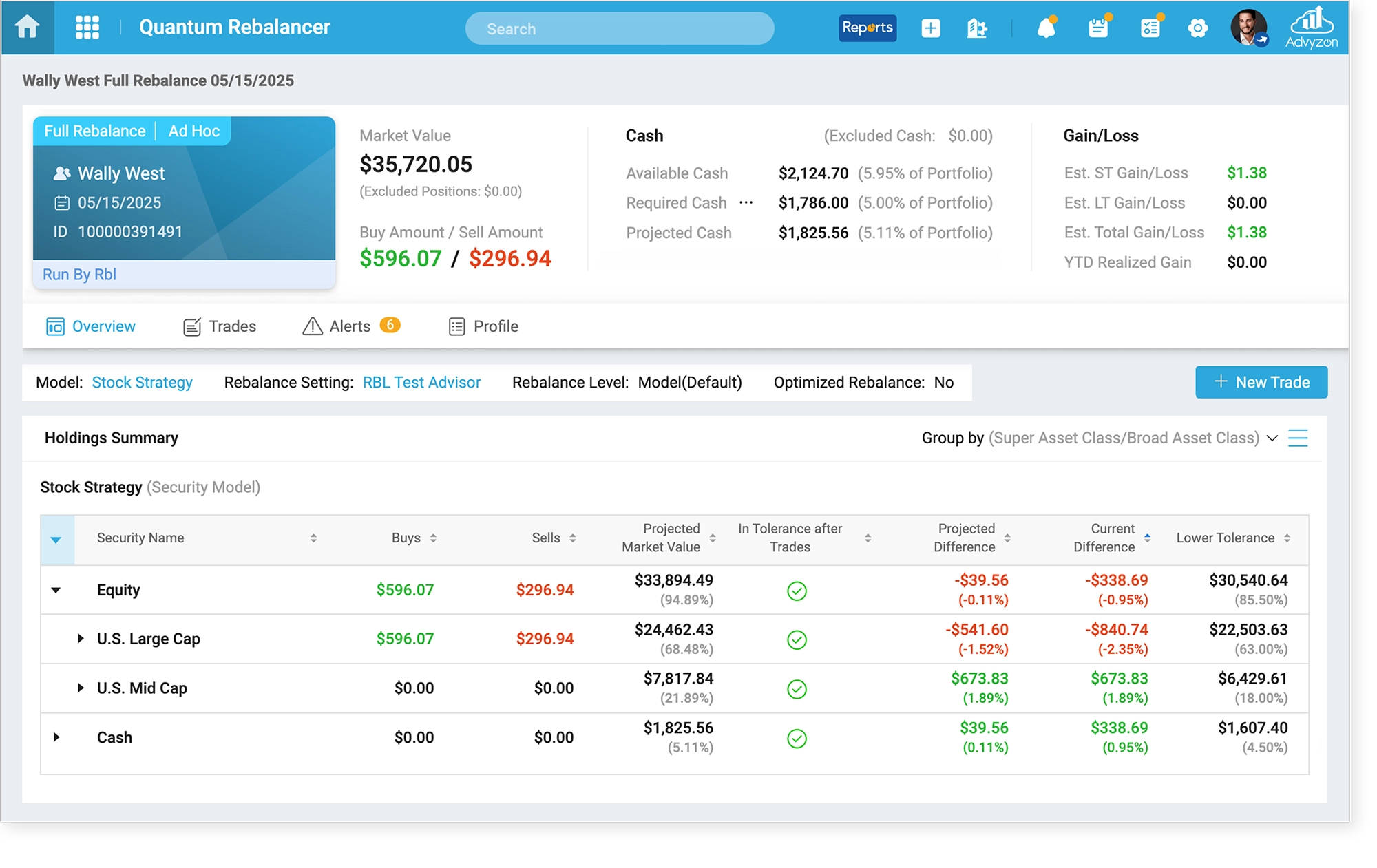

Rebalancing and Trading

With nine different rebalancing and trading modes available, you have a wealth of functionality at your fingertips. Trade based on model deviation with full rebalance & out of balance modes.

Cash Management

Managing cash needs is easy with flexible options to track and generate client requests or maintain existing cash values. Our cash settings allow for one-time requests or ongoing RMD needs.

Tax Loss Harvesting

Our tax loss harvesting options allow you to generate losses within certain parameters, within a loss threshold or all losses available. Easily view tax implications throughout the trade review process with multiple customizable columns & data points.

Multi Custodial Trading

Enhance your trading processes with all the major custodians. Its simple to create block and allocation files, manage limit orders, and submit trades, whether you utilize custodian specific file formats or through our FIX trading platform.

Quantum Rebalancing

Effortless rebalancing. Confident results.

Choose from nine rebalancing methods, including tax-aware strategies, trade-to-target, or tactical security swaps.

Build models around individual securities or multi-level asset classes—or combine them as models of models. You can group portfolios by Client, Client Sub-Groups, or Accounts, set trade preferences by client or model, and automate everything from drift monitoring to block trade execution. Trades flow seamlessly through to custodians via FIX Flyer, delivering precision and efficiency.

Built for Precision. Designed for Performance.

Recognized in 2025 Kitces Report for Trading & Rebalancing Innovation.